Deciding to buy an apartment is a significant step, and whether you’re breaking into the property market, downsizing, or just after a change, it’s essential to weigh the pros and cons. On the sunny side, you’re probably going to shell out less cash than you would for a house, which in today’s market is a rather tempting thought, isn’t it? Plus, let’s not forget the potential perks of living in a buzzing city centre or a cosy suburb, where everything you need could be just a stones throw away.

However, buying an apartment isn’t without its drawbacks. You might find yourself grappling with less space than a house offers, and sometimes, privacy can take a hit. Oh, and those body corporate fees can sneak up on you, alongside various rules that could cramp your style. Considering the choice from every angle is key to making a decision that fits your lifestyle and budget. So, let’s chat about what this could mean for you in the land Down Under, where the property game has its own set of rules.

Key Takeaways

- Apartments can be more affordable and conveniently located.

- Space and privacy can be limited in apartment living.

- Ongoing fees and regulations are part of apartment ownership.

Pros of Buying an Apartment

Ready to dip your toes into the property market? Apartments can be a gem in the urban jungle. Let’s unpack why your next purchase might just be a set of keys to a swish apartment.

Affordability and Expenses

Have you noticed that buying a house is akin to scaling a mountain? The median unit price is often significantly lower than that of houses, making apartments a more affordable option for entering the property market. Plus, when it comes to home loans, a lower purchase price translates to smaller loan amounts and often, more manageable repayments. Here’s a quick glance:

- Median unit price: Often lower than houses

- Home loans: Smaller loans, more manageable repayments

Low Maintenance Lifestyle

Sick of spending every weekend on chores? Embrace the low maintenance lifestyle of apartment living. Cleaning is a breeze when you’ve got less space to worry about. And don’t get me started on maintenance costs! They’re typically lower since you won’t be dealing with a big backyard or exterior upkeep. Here’s the score:

- Cleaning: Less space = quicker cleaning

- Maintenance costs: Less responsibility for outdoor areas

Amenities and Convenience

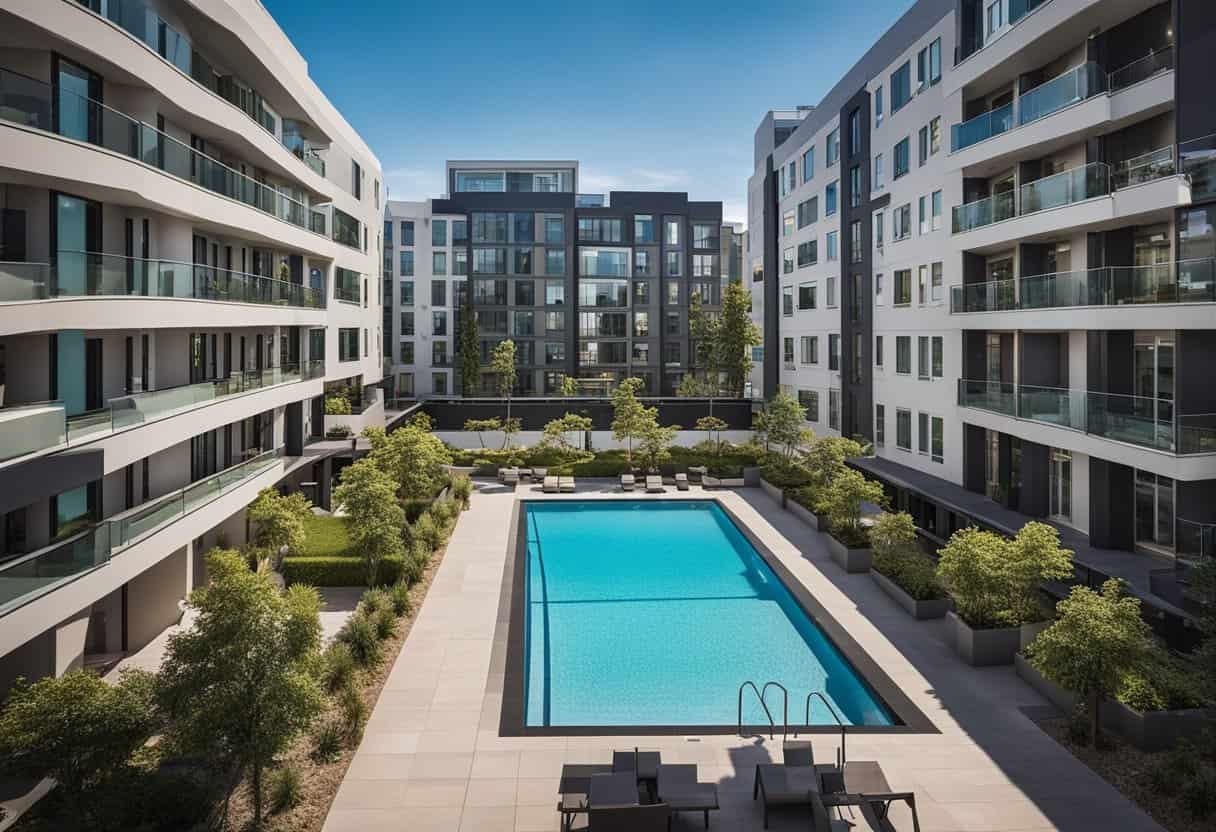

Who needs a gym membership when you’ve got a fitness centre in your building? Modern apartment complexes often come with amenities that can include a gym, pool, tennis court, even a spa. These facilities enhance your living experience and are a hop, skip and a jump from your front door.

- Amenities: Gym, pool, tennis court

- Convenience: All within your own building

Security and Safety

Ever fretted about security while planning a holiday? Apartments typically offer better security features – think underground parking, secure entry points and, in many cases, surveillance systems. Plus, having neighbours close by can be a reassurance in itself. It’s like having a built-in neighbourhood watch!

- Security: Secure entry, surveillance systems

- Neighbours: A community to watch over each other

Investment Potential

Thinking of an investment property? Apartments can be a smart choice. While they may not always witness the same level of capital gains as houses, they can be more accessible as a first investment and easier to rent out. You’re not just buying a home; you’re stepping onto the property ladder – and that’s a savvy move.

- Investment property: A step on the property ladder

- Rent: High demand in urban areas, easier to find tenants

With these positives in your pocket, you’re well on your way to making an informed decision about whether apartment living suits your lifestyle and investment goals. Who knows, you might soon be the toast of the block in your very own urban oasis!

Cons of Buying an Apartment

Buying an apartment can be a smart financial move for many, but it’s not without its drawbacks. Before you sign on the dotted line, consider the limitations that come with apartment living.

Space and Privacy

Apartments often provide less floor space than houses, which might make you feel cramped, especially if you’re coming from a larger home. Your balcony might be the only outdoor area you have, which is a far cry from a backyard. And remember, sharing walls means less privacy—get ready to potentially know more about your neighbours’ lives than you might like.

Restrictions and Limitations

Fancy a bit of DIY or want to adopt a furry companion? You might need to check with the body corporate first. The restrictions on renovations, pets, and even DIY projects are often much tighter for apartment dwellers. There’s a trade-off between convenience and autonomy here.

Ongoing Costs

You know those pesky strata fees? They cover communal maintenance, sure, but can be a significant, recurrent expense. Add rates, water bills, electricity, and insurance, and your monthly outlays could be more than you’ve bargained for.

Noise and Interference

Living in close proximity to others in apartment complexes means noise can be a constant companion. Whether it’s late-night parties or high-heels at dawn, noise from your neighbours can be more than a minor annoyance.

Market Factors

Apartments don’t always enjoy the same rate of appreciation as houses, particularly in suburban areas where the median house price might see a steadier climb. While a unit in the city might hold its value due to location, this isn’t a one-size-fits-all market fact.

Location and Accessibility

When you’re on the hunt for a new apartment, have you thought about the impact your location and accessibility will have on your lifestyle? Let’s dig into how city living might suit your fast-paced life, why a suburban setting could be perfect for family life, and how being close to amenities adds convenience.

City Living

Ever fantasized about living where the action is? Alluring city centres beckon with their vibrant lifestyle. Here’s the scoop:

- Work: Being in the city can mean a shorter commute to work, often allowing for more sleep-ins or after-work activities.

- Lifestyle: A city pad gives you direct access to a bustling social scene, trendy eateries, and cultural events.

Suburban Benefits

Are you craving a bit more breathing space? Suburbs can be a sweet spot for various reasons:

- Families: Suburbs often mean more room, safer streets, and a community feel, making them great for families.

- Garden Space: Fancy a bit of gardening? You’ll likely have more space to grow your own garden or just enjoy a lush lawn.

Proximity to Amenities

What’s life without your local haunts and conveniences? Let’s break down the essentials:

- Shops: Whether it’s your weekly grocery run or retail therapy, being near shops is a huge plus.

- Leisure: Close to your apartment, you might find gyms, parks, and maybe even community gardens to keep fit and relax.

Financial Considerations

When you’re eyeing that chic apartment, it’s not just the view that should capture your attention. Your wallet deserves a peek too. How will your purchase impact your financial landscape? Let’s crunch the numbers.

Mortgage and Loans

Securing a home loan for an apartment often mirrors the process for a house. Lenders will assess your income, deposit size, and property value. An apartment might offer a more affordable entry point into the property market. Your mortgage broker can be a key ally, helping you navigate loan options and secure a deal that fits your budget like a glove.

- Home Loans: The kind of loan you choose (fixed, variable, split) will affect your repayments and flexibility.

- Mortgage Broker: Their expertise can be invaluable in finding competitive rates and terms tailored to your circumstances.

Investment Value Analysis

Buying an apartment isn’t just about a place to crash—it’s an investment. Apartments in high-demand areas may promise capital gains over time. But what about now? You’ll want to weigh the initial affordability against potential value appreciation.

- Affordability vs. Value: Lower median costs compared to houses, but growth rates can vary.

- Capital Gains: Location, location, location! The right spot can mean your investment is poised to climb.

Remember, while you’re dreaming about that balcony view, stay grounded in the financial realities. Your future self will thank you for it!

Building and Community Features

When you’re thinking about buying an apartment, it’s not just the inside of your potential new home that counts. Have you considered the shared spaces and the age of the building itself? These aspects can have a huge impact on your lifestyle and your pocket!

Common Areas and Facilities

Have you ever dreamed of having a pool, but without the hassle of cleaning it? Living in an apartment could make this a reality. Often, apartment complexes come with a host of common facilities:

- Gym: A fitness centre within your building can save you a membership elsewhere.

- Pool: Ideal for a morning swim or weekend relaxation.

- Tennis Courts: Some luxury buildings may even offer tennis courts for the sporty types.

Maintaining these areas is usually managed by the body corporate, which means less work for you. But keep in mind, amenities like these can influence the cost of your strata fees.

Quality and Age of the Building

Wondering if your potential new home will stand the test of time? Here’s what you need to know:

- Newer Developments: Might offer modern conveniences, but it’s good to check the workmanship. Don’t just fall for the sparkle!

- Older Buildings: They can be full of character, but might require more maintenance, like repainting or renovation.

Remember, no matter if it’s a freshly built block or a seasoned structure, the importance lies in the upkeep. Regular maintenance ensures the building remains safe and aesthetically pleasing for everyone.

Before making your offer, have a good look at the building’s condition – it’s an excellent indicator of how well it’s been looked after. And if you do spot a few wrinkles or signs of wear, consider how that could affect future costs. Who said getting older is easy?

Legal and Administrative Aspects

Hey, before diving into your potential apartment purchase, have you considered the nitty-gritty of legal and administrative matters? Things can get a bit dry, but being clued up on these can save you from a headache later. Let’s break down strata fees and the dealings with body corporate, shall we?

Understanding Strata Fees

Strata fees, what are they all about? Well, these are your ticket to the communal living club. They cover things like garden maintenance, communal area upkeeps, and even building insurance. Each quarter, expect to chip in for the collective good. Breakdowns often look like this:

- Gardening Services: $150

- Building Insurance: $200

- Maintenance Fund: $100

Keep in mind, fees can vary wildly depending on the place. More amenities usually mean a larger slice of your budget pie going towards these costs.

Dealing with Body Corporate

Now, the body corporate is essentially your neighbourhood’s rule-keeper and peacekeeper rolled into one. Ever thought about renovating your apartment? Hold your horses—you’ll probably need their thumbs up first. They’re in charge of enforcing the building rules, and that includes approval for any structural changes.

Here’s a quick peek at what else the body corporate handles:

- Administrative Fund: Planned expenses, like cleaning services.

- Sinking Fund: Long-term, big-ticket items—think roof repairs.

- Building Rules: Everything from pet policies to noise restrictions.

Familiarising yourself with their role can smoother your apartment living experience. Just remember, a productive relationship with your body corporate can lead to a happy home, so don’t be shy to engage with them!

Frequently Asked Questions

Curious about stepping into apartment living? Below, we tackle some of the key queries you might have, providing a sneak peek into the world of apartment ownership.

What are the financial benefits of owning an apartment compared to a house?

Owning an apartment often means a lower entry price compared to houses in the same area, freeing up your budget for other investments or lifestyle choices. Plus, your strata fees cover maintenance, which can make financial planning a bit more predictable.

Could you list some common challenges that apartment dwellers face?

Neighbourly noise can be a bother when you share walls. Also, you might face constraints with renovations due to strata rules, so if you’re a DIY enthusiast, this can be restrictive.

Is investing in an apartment a smart move in the current Australian property market?

In many Australian cities, apartments can offer strong rental yields, particularly in high-demand urban areas. However, market conditions are always changing, so it’s crucial to research and perhaps seek advice from property experts before diving in.

What should potential apartment buyers be wary of during their property search?

Keep your eyes peeled for the strata fees which cover communal area upkeep; they can be substantial. Also, look into the sinking fund’s health – this is the pot of money set aside for major repairs.

How might family life flourish in an apartment setting?

Apartments can foster a sense of community, often featuring shared spaces like pools and gardens, where your family can mingle and kids can make friends. Plus, less time spent on maintenance means more family fun time.

What are some potential drawbacks to apartment ownership that buyers should consider?

You could face limitations on pet ownership and there might be less privacy compared to a detached house. Storage space is often at a premium too, so if you’re not keen on minimalism, that could be a sticking point.